The Basics of Money

Don't be financially delusional in a declining empire.

This week there was another debate on the timeline about Rural America…seems to happen every few months. But this wasn’t your typical Urban life vs. Rural life debate. It was about whether or not you can find a beautiful wife at a truck stop in the midwest! Simply riveting.

The debate turned into a bigger discussion about why “young men” should drop everything, hit the open road and go on an adventure. Mike Cernovich and Matt Walsh, two early gen X’ers/late millennials, have been the most vocal about this. Millennials love to find themselves. As I called out, there’s something crucial missing from this debate: money.

Let me be clear — this post is not about whether you should go on adventures. My subscribers know I strongly advocate for taking risks and getting accustomed to the unknown. But I don’t advocate for being stupid either.

Someone asked me recently what my other interests are besides what I post about. I said I’m also interested in watches, astrophysics, Renaissance art, cooking and macroeconomics. I think about the American economy and the dollar quite a lot.

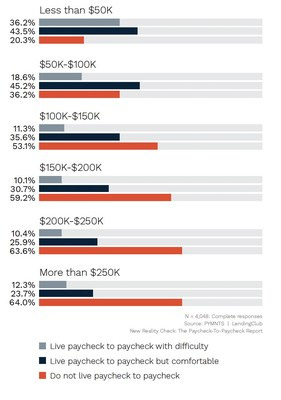

Most Americans don’t know how to think about money anymore. And I mean that literally. How much should a decent car cost? What about a house? What’s the new ‘comfortable salary’ everyone should be aiming for? It’s certainly not $100K like it was 10 years ago. It’s not even $250K. Recent data shows over 25% of people making over $250K are living paycheck-to-paycheck.

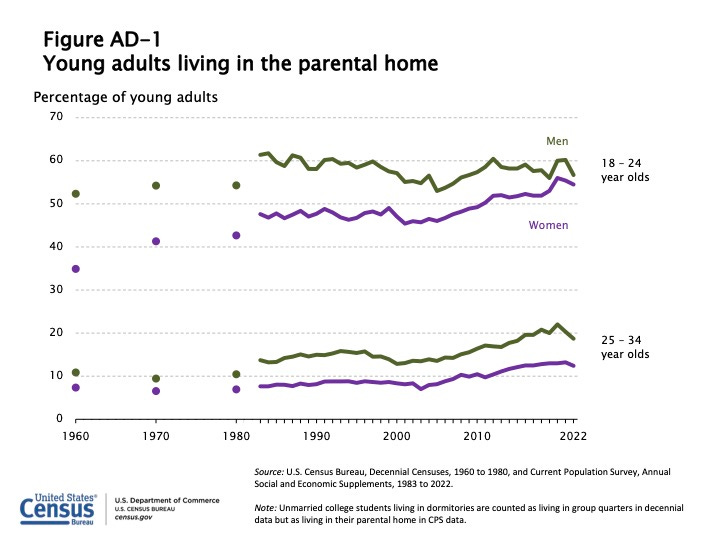

Americans, overall, aren’t doing well financially. Over 50% of Zoomers still live with their parents.

Almost 1/3 of American’s don’t have any money saved up in case of an emergency. They’re living on the cusp of sanity and homelessness.

Everyone’s financial situation is different. Some people have parents who support them. Some people are doing just fine. They have a full-time job, savings, maybe some investments and some PTO to be used. But most Americans are pretty broke.

What does it mean to be broke? Most people think being broke means “having no money”, but that’s a very low bar. To be broke means you’re at very high risk of possibly running out of money. If you’re living paycheck-to-paycheck, you’re broke. If you don’t have an emergency fund, you’re broke. If you’re swimming under mountains of debt and can barely keep your head above water, you’re broke.

I’m not going to tell anyone what to do. If you’re broke and you want to travel spontaneously and “look for a wife”, by all means. But thinking things through never hurt anyone. How long is that trip going to last? Gas is ~$4/gallon now. Food that doesn’t poison you isn’t cheap. Hotels are expensive. And hey, if you want to sleep in your car — by all means. But what if things go well with your newfound smokeshow you met at the gas station? Having sex in your car is fun…if you’re still in high school. Wouldn’t you rather fuck her in a hotel room like an adult?

Regardless of government data, America is in a recession. Everyone can feel it. Everything is becoming more expensive and more people are relying on debt to make ends meet. People allow the little money they have get eroded by inflation, which is only going to get worse. There’s never been a better time to be realistic about money and to think about it in a way that benefits you 10 years from now. There’s way too much magical thinking going on.

I’m shifting gears here. I know this isn’t what I normally write about. But I think the way I think about money both practically and philosophically could help some people who may be struggling with it right now whether it comes to making more of it, being more financially disciplined, or getting yourself out of debt. This is not a ‘How To’ anything, but a breakdown of the basics from someone who knows what life is like with and without money.

“This is not financial advice.”